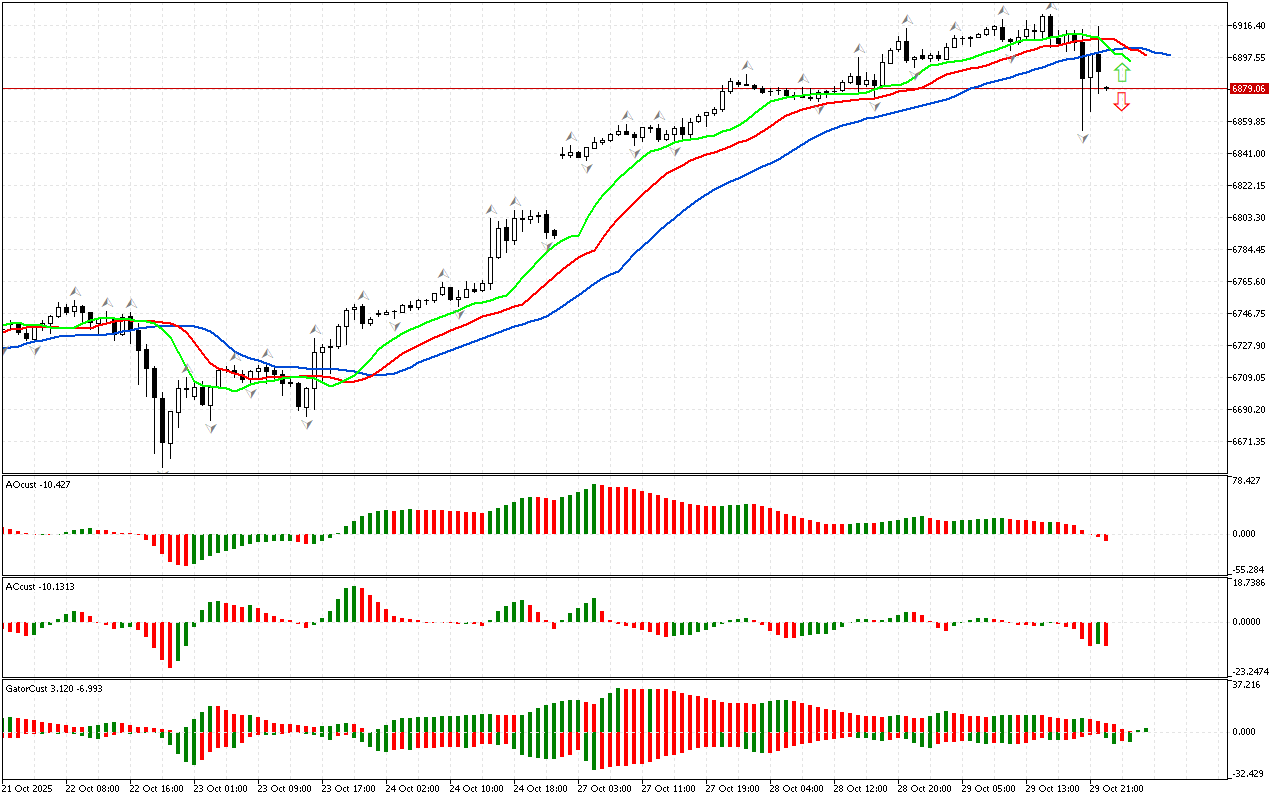

There remains uncertainty regarding S&P 500. The price neither fell below, nor rose above any fractal. In this situation, it is worth refraining from active actions in the market and waiting for new signals to appear. A price raising above the upper or its falling below the lower fractal will help to determine the prevalent direction.

The Alligator’s lines are laid in northern direction and the Alligator’s mouth is open. This means that first of all attention should be paid to the appearance of the upper fractals. A rising of the price above such a fractal will be a signal, defining the market phase as northern.

At the same time, the AO indicator remains in the negative zone.

The color of the histograms of the Gator indicator changes, so this indicator has not formed a clear signal yet.

Let’s summarize. The phase space is not defined. Therefore, it is worth ignoring the signals of other indicators for now and waiting for the breakdown of one of the fractals. This is a predictive event that will help determine the market phase and the priority direction of price movement.

📊 Buy Stop 6922.67

❌ Stop Loss 6904.59

✔️ Sell Stop 6854.29

❌ Stop Loss 6906.96

After entering the market, Stop Loss is moved along the red line after the closing of each candle. The profit is fixed by moving Stop Loss, or when impulse weakening signals appear on the AO, AC, Gator indicators.

S&P 500 H1: The Chaos Theory Forecast for the Asian Session on 30.10.2025