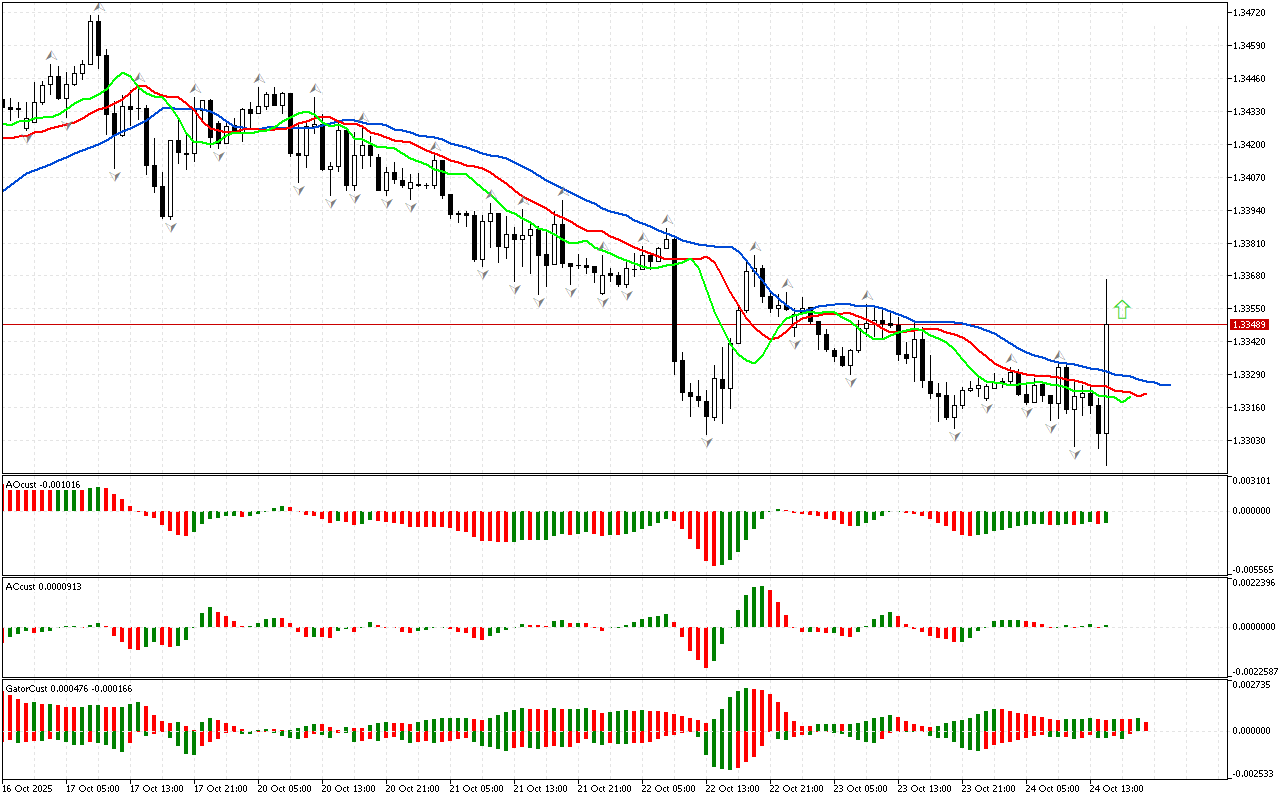

Traditionally, the review begins with examination of the first market dimension. The price has risen above the upper fractal. This defines the phase space as northern. This signal indicates the possible development of an upward movement. To assess its strength and energy, let’s consider other market dimensions within the framework of Bill Williams’ strategy.

An inverse Saucer signal has appeared on the Awesome Oscillator indicator. It indicates a possible change in the direction of the market to downward. When this entry point signal appears, the market can be considered when the price falls below the local minimum.

At the same time, the AC and AO indicators turned red. This signals that the strength and energy of the upward impulse have deceleration. This may lead to the development of a deeper correction or a change in trend. However, the northern movement scenario remains prevalent as long as the price remains above the red Alligator line.

The histogram of the Gator indicator has not formed a clear signal yet. The color of the histograms changes, indicating a change in market phase.

As a result, there is a northern phase space. At the same time, some indicators indicate the possible development of a pullback movement or the transition of the market to a new phase.

📊 Buy Stop 1.33666

❌ Stop Loss 1.33297

After entering the market, Stop Loss is carried along the red line after the closing of each candle. The profit is fixed by moving Stop Loss, or when opposite signals appear on the AO, AC, Gator indicators.